Rancid wrote:

A collapse would mean we're all in the streets, half naked trying to kill each other for dinner.

No -- it means that the capitalist system of economics that we're all tied-into would no longer provide any kind of interchangeability, as through currency and debt, for the real-economy to do its thing, that we all rely on.

wat0n wrote:

And it would've been even worse had nothing been done.

I never fancied you as a radical libertarian, @ckaihatsu

Well, to clarify, I *am* more of an accelerationist, or 'apocalypticist', and at the time I found it curious, and even shocking, that libertarians were calling for the system to be left to rise or fall by its own merits. One of those 'crucible' moments in history, I'd say.

Here's my cred:

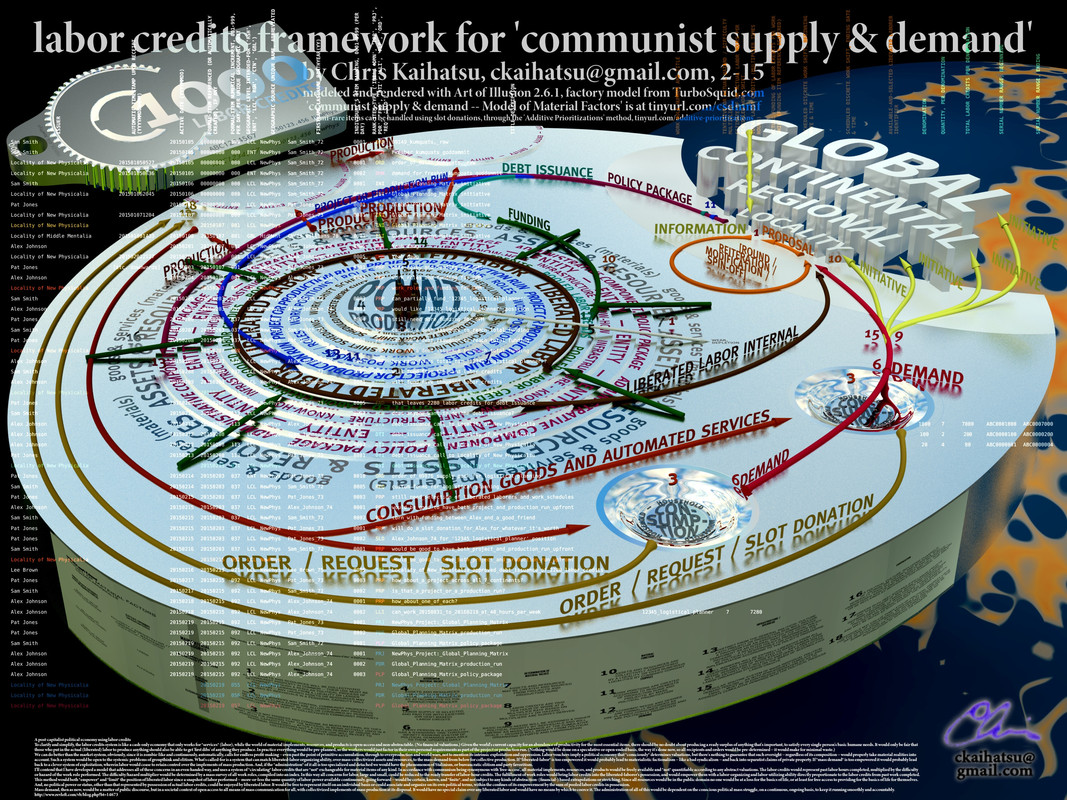

labor credits framework for 'communist supply & demand'

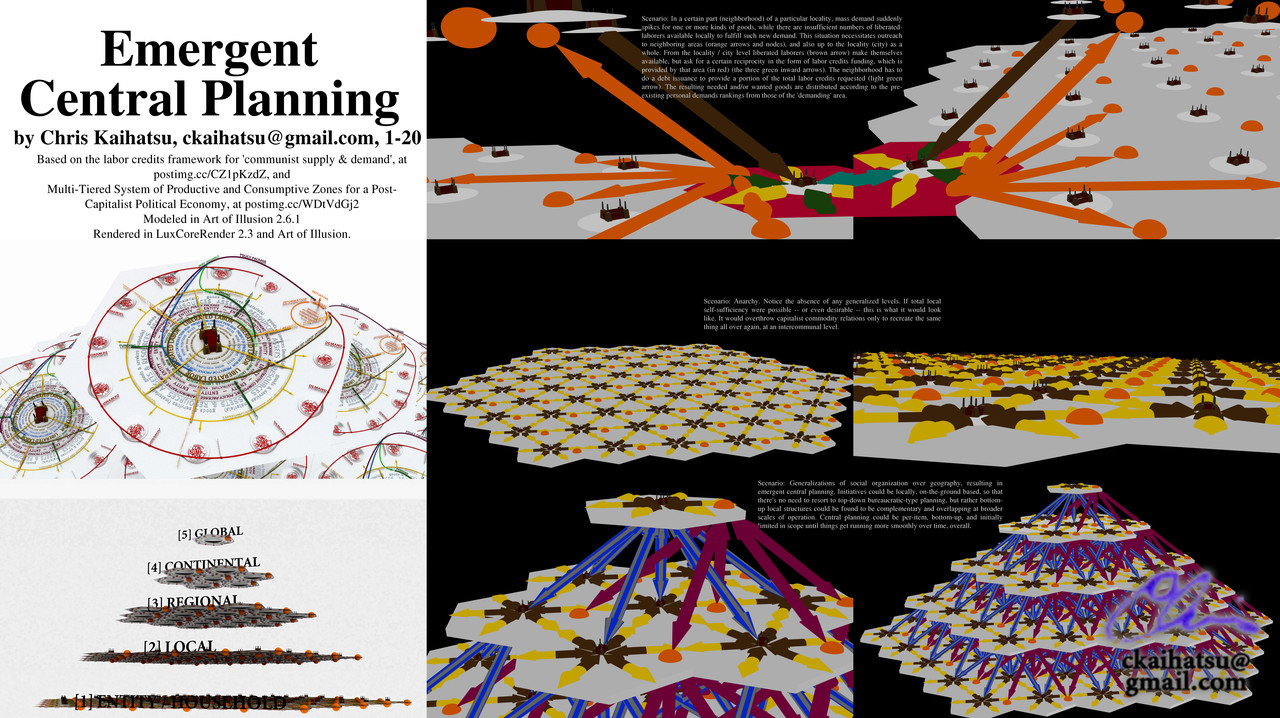

https://web.archive.org/web/20201211050 ... ?p=2889338Emergent Central Planning

- By wat0n

- By wat0n